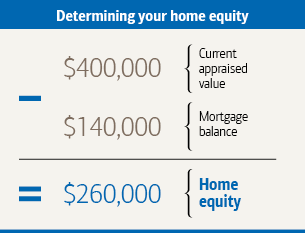

Formula for home equity

Levered Beta Formula Example 1. Assets -Liabilities Equity.

What Is Home Equity How To Determine The Equity In Your Home Zillow

Your net worth is based on how much of your home you actually own.

. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. The Enterprise Value or EV for short is a measure of a companys total value often used as a more comprehensive alternative to equity market capitalization. Examples to Calculate Owners Equity Example 1.

It is a public listed company and as per available information its unlevered beta of 09 while its total debt and market capitalization stood at 120 million and 380 million respectively as on December 31 2018. This lets us find the most appropriate writer for any type of assignment. Firstly calculate the total liabilities of the company by summing up all the liabilities which is available in the balance sheet.

Return on Equity ROE is the ratio that mostly concerns shareholders management teams and investors in. Return on Equity ROE is one of the Financial Ratios use to measure and assess the entitys profitability based on the relationship between net profits over its averaged equity. Fun time International Ltd.

Debt to Equity Ratio in Practice. Now you just plug the numbers in. A Microsoft 365 subscription offers an ad-free interface custom domains enhanced security options the full desktop version of Office and 1.

Bangkok September 6 2022 Bitkub Blockchain Technology Bitkub Chain and Bitkub NFT developer invite you to open the new experience of the digital world and participate in the NFT activities at Bitkub NFT Fair event on September 10-11 at Bitkub M Social Helix Building 9th floor The Emquatier. The more equity you have the more financing options may be available to you. Eventually once the mortgage is paid off and you are no longer leveraged the appreciation component of ROE will exactly match the appreciation rate of the property in our example.

Your equity helps your lender determine your loan-to-value ratio LTV which is one of the factors your lender will consider when deciding whether or not. DebtEquity DE Ratio calculated by dividing a companys total liabilities by its stockholders equity is a debt ratio used to measure a companys financial leverage. Two main important elements of this ratio are Net Profits and Shareholders Equity.

Wages for essential home care workers are approximately 12 per hour putting them among the lowest paid workers in our economy. Examples of liabilities include accounts payable long term debt short term debt capital lease obligation other current liabilities etc. Firstly pull together the total assets and the total liabilities from the balance sheet Balance Sheet A balance sheet is one of the financial statements of a company that presents the shareholders equity liabilities and assets of the company at a specific point in time.

When we look at Home Depots Equity turnover we see that until 2012 turnover was relatively stable at around 35x. Thats the magic number for requesting that a lender waive its private mortgage insurance requirement. Weve developed a suite of premium Outlook features for people with advanced email and calendar needs.

Taking the value of the 2018 year Sum of total liabilities 45203. We own and operate 500 peer-reviewed clinical medical life sciences engineering and management journals and hosts 3000 scholarly conferences per year in the fields of clinical medical pharmaceutical life sciences business engineering and technology. It can be represented with the accounting equation.

It is based on the accounting equation that states that the sum of the total liabilities and the owners. Heineken ramped up the post-race atmosphere at the Formula 1 Heineken Dutch Grand Prix with a podium performance from internationally renowned Dutch producer and DJ Afrojack. If as per the balance sheet the total debt of a business is worth 50 million and the total equity is worth 120 million.

Heres an example assuming a 400000 loan amount with a 130000 existing mortgage balance. Let us take the example of a company named JKL Inc. Debt to Equity Ratio short term debt long term debt fixed payment obligations Shareholders Equity.

Debt to Equity Ratio Total Debt Shareholders Equity. However since 2012 Turnover of Home Depot has started climbing steeply and currently stands at 11. Breaking News First Alert Weather Community Journalism.

Home Value - Home Value 01 - Existing Primary Mortgage Balance Loan Amount. In fact one in six workers in this sector live in poverty. Started the business one year back and at the end of the financial year ending 2018 owned land worth 30000 a building worth 15000 equipment worth 10000 inventory worth 5000 debtors Debtors A debtor is a borrower who is liable to pay a certain sum to a credit supplier such as a.

A firm uses cost of equity to assess the relative attractiveness of investments including both internal projects and external acquisition opportunities. We are an Open Access publisher and international conference Organizer. You can borrow against your home using second mortgages and home equity lines of credit HELOCs.

Now the question is what you would consider as sales. Companies typically use a combination of equity and debt financing with equity capital being more expensive. To illustrate the computation of levered beta.

Generally speaking equity is the value of an asset less the amount of all liabilities on that asset. Lenders often prefer an LTV below 80 to approve a loan but some lenders go higher. Positive cash flow indicates that a companys liquid assets are increasing enabling it to settle debts.

Equity Turnover Formula Net Sales Average Shareholders Equity. As the home increases in value and you pay down the mortgage your leverage ratio decreases over time. Sum of shareholders equity 260280 ie the sum of equity capital and retained earnings Retained Earnings Retained Earnings are defined as the cumulative earnings earned by the company till the date after adjusting for the distribution of the dividend or the other distributions to the investors of the.

Cash flow is the net amount of cash and cash-equivalents moving into and out of a business. You could borrow up to 230000. Enterprise Value EV.

The appreciation return on equity component is the big driver. You can use the mortgage calculator to determine when youll have 20 percent equity in your home. Your home equity is the difference between the appraised value of your home and your current mortgage balances.

Cost of Equity is the rate of return a company pays out to equity investors. Having a million-dollar home doesnt do you much good if you owe 999000 on the property. Rocket Mortgage has a minimum loan amount of 45000 for home equity loans.

The formula for debt to equity ratio can be derived by using the following steps.

This Article Explains The Amortization Calculation Formula With A Simple Example And A Web Based Ca Home Equity Loan Home Equity Loan Calculator Mortgage Loans

Home Equity Line Of Credit Heloc Rocket Mortgage

How To Calculate Equity In Your Home Nextadvisor With Time

How It Works Alpine Credits Ltd

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Home Equity Loan Mortgage Amortization Calculator

Home Equity Line Of Credit Heloc Rocket Mortgage

Net Worth Calculator Find Your Net Worth Nerdwallet

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Equity Calculator Top Sellers 56 Off Www Ingeniovirtual Com

Mortgage Formula With Graph And Calculator Link

Heloc Calculator Calculate Available Home Equity Wowa Ca

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Equity Line Of Credit Heloc Rocket Mortgage

Heloc Calculator

How To Find Out How Much Equity You Have In Your Home Discount 59 Off Www Unpetitoiseaudanslacuisine Com